Preliminary air cargo figures for April indicate that worldwide tonnages for the month were up by +6%, year on year (YoY), driven by a +10% YoY increase from Asia Pacific origins, as US importers adjust to big changes in China-US trade rules.

According to the latest figures from WorldACD market data, chargeable weight in April was up, YoY, from all of the main world origin regions – with the exception of Middle East & South Asia (MESA), where tonnages were flat. Alongside +10% YoY growth from Asia Pacific origins, there were increases of +7% from Central & South America (CSA), +5% from North America, +3% from Africa, and +2% from Europe.

The YoY weight increase of +6% in April follows an increase of +4% in March, and +2% increase for Q1 2025. This makes for a tonnage increase in the first four months of 2025 of +3% compared with the same period in 2024. Compared with March, tonnages in April were down from all the main regions except CSA, which achieved a +16% month-on-month (MoM) rise. Meanwhile, there were MoM declines from Europe (-10%), MESA (-12%), North America (-7%), and Asia Pacific (-5%).

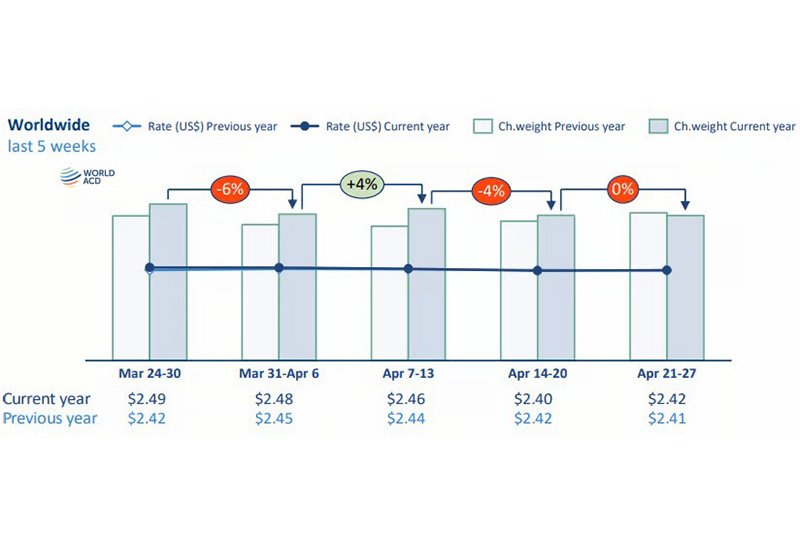

Overall worldwide rates in April of US$2.43 per kilo, based upon a full-market average of spot rates and contract rates, were stable compared with the previous month and the previous year. Significant YoY variations included a +7% increase from Africa origins and a -14% drop from MESA, from where rates last year were inflated because of the Red Sea shipping disruptions.

Amid the current uncertainty of global markets, and the lead-up to the end of ‘de minimis’ exemptions from 2 May for US imports from China, worldwide tonnages in the final full week of April (week 17, 21 to 27 April) held firm, buoyed by a +19% WoW increase from CSA due to the annual surge in Mother’s Day flower shipments. Other highlights included a +4% WoW (and YoY) increase in MESA origin shipments, and a +3% WoW increase from Asia Pacific, taking tonnages from that key region +6% higher than in April 2024. But average rates from Asia Pacific in week 17 edged downwards by a further -1%, WoW, taking them slightly below (-1%) their level this time last year, based on the more than 500,000 weekly transactions covered by WorldACD’s data.

The end of ‘de minimis’ exemptions for US imports from China and Hong Kong from 2 May is widely expected to lead to a significant drop in demand and capacity from China and Hong Kong to the USA, with some freighters expected to be repositioned to other markets, leading to potential marked volatility in demand, capacity, and pricing on several markets in the coming weeks.